Web Exclusive

Maintaining Financial Health — Five Steps Radiology Groups Can Take to Strengthen Their Post-Pandemic Practices

By Andrew Colbert

Radiology groups must make urgent decisions to best position their practices for long-term success and weather COVID-19 challenges. With COVID-19 creating unprecedented economic uncertainty, radiology group leaders need to reflect on their strengths, weaknesses, and threats in order to avoid critical mistakes and capitalize on emerging opportunities that will surface during and after this pandemic. Successfully making these decisions in the near term will help ensure practices can endure market instability and be best positioned for long-term growth. As I routinely speak with dozens of radiology groups across the United States, the following five core actions have emerged that provide a blueprint radiology practices can use to chart an optimized path forward in uncertain times.

Leverage financial modeling and scenario analytics. Practices must immediately assess liquidity needs and cash runway for the next six months. Decisions should be made with this timetable in mind, and sound business decisions made earlier will allow practices to capitalize on the expected demand surge once COVID-19’s strain on the health care system subsides and more elective procedures are permissible. Groups must also perform financial stress testing and scenario analyses, often aided by a trusted advisor.

Proactively manage operating expenses. During COVID-19, flattening practices’ expense curve is key. The sooner practices can tighten noncritical expenditures, the longer their runway to weather expected and unexpected economic circumstances will be. Maximizing liquidity is key in uncertain economic periods.

Radiology groups can manage operating expenses in the following ways:

• determine the need for furloughs, layoffs, and pay reductions;

• reduce or eliminate nonessential business expenses;

• pause noncritical purchasing of supplies and other arrangements; and

• extend vendor payables as long as possible, review contracts and applicable terms, and rationalize vendor spending.

There are additional avenues for optimizing tax strategies to free up cash flow quickly. These strategies include employer portion payroll and Social Security tax deferral, increases to the allowable interest expense deduction, and the net operating loss deduction to be applied to further backdated periods.

Take advantage of revenue opportunities. Radiology groups should evaluate potential payment acceleration and revenue enhancement strategies with their payers. Practices that help treat COVID-19 patients may be eligible for a 20% increase in weighting for diagnosis-related groups. There will also be a Medicare 2% sequestration suspension through the remainder of 2020.

Radiology groups must optimize service offerings today to address short-term changes in market demand, while remaining prepared for the surge in demand after COVID-19. Practices need to review daily where resources are allocated, to only service existing demand during COVID-19 and cut back everywhere else.

COVID-19 has presented significant opportunities in telemedicine. Telemedicine is a great opportunity for groups to expand their practices. This opportunity is significant for practices that offer leading subspecialty expertise. These practices can offer in-demand subspecialty reads to other radiology groups across the country that cannot offer the needed service, opening doors to cross-practice partnerships and new revenue sources.

Radiology groups need to be proactive in ensuring telehealth success. This includes ensuring active state-by-state physician licenses, investing in home workstations, tracking data to demonstrate effectiveness of telehealth services, and identifying partnership opportunities to capture new revenue sources during uncertain or negative economic periods. If proven, Medicare is also reimbursing office rates to many providers who have both visual and audio telemedicine capabilities, eg, conducting IR consults remotely.

The recently passed CARES Act is also expanding telehealth services across the United States, with up to $200 million available in federal funding. Current projections estimate about 1 billion telehealth visits in 2020. There is great opportunity and critical demand in telehealth services for radiology groups.

Seek external financing options. The aforementioned CARES Act, a $2 trillion relief and economic stimulus package to help alleviate the economic impact caused by the COVID-19 pandemic, provides practices with helpful external financing options that should be considered. The bill allocated $377 billion to small business loans, including $349 billion in low-interest loans for small business employers to avoid layoffs or closure as part of the Paycheck Protection Program (PPP). A second round of PPP funding was announced on April 27.

Government-provided funds can only last so far, however, as the initial $349 billion appropriated for PPP was exhausted in just 13 days. Private debt and equity capital sources can provide sound options, in addition to government funding options. These capital sources can be secured at historically low interest rates, allowing radiology groups to maintain business continuity and support long-term equity value creation. Commercial banks, FINCO/BDC, private equity, and venture capital represent the four core types of capital sources available.

More details about the CARES Act and available small business funding are available at www.ziegler.com/covid-19.

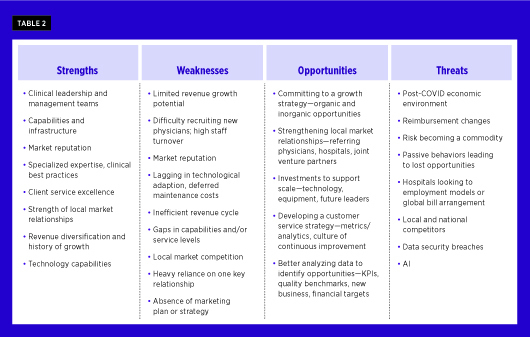

Evaluate the long-term strategic roadmap. Every radiology group should perform a SWOT analysis, which examines a practice’s strengths, weaknesses, opportunities, and threats. While business activity may slow during COVID-19, now is a perfect opportunity to consider how practices measure along a gridline, similar to the below table.

Questions to ask:

• What is your practice doing well? What is your differentiator from competition?

• What are your practice’s weaknesses? What may competitors do better than your practice?

• What are the opportunities for growth? What markets are limited from a competitive standpoint?

• What are some of the existing threats as well as new threats emerging from this dynamic?

More of these questions are listed below. Now is the time to execute an earnest assessment and make necessary changes to improve your competitive positioning.

Conclusion: Strategies for Long-Term Success

There is a consistent roadmap to achieving long-term practice sustainability in any market environment. Begin by establishing short- and long-term goals. Review your objectives and long-term goals, perform a detailed financial review, and develop a five-year strategic plan.

Perform a strategic assessment of your business to gain an understanding of its current and potential valuation. Evaluate strategies to build shareholder value and conduct a SWOT analysis.

Identify practice gaps, limitations, and opportunities, including what you need to do to strengthen the practice and improve competitive positioning. Also identify potential levers to improve financial performance.

Evaluate strategies for achieving scale. Assess the pros and cons of various strategic options. Consider a partner to accelerate your growth trajectory, and develop criteria for the ideal partner.

Finally, consider discussions with partners and/or investors. Explore potential options to gain scale, evaluate strategic capital opportunities, and determine cultural fit and strategic synergies.

By considering the aforementioned steps and roadmap, the best radiology groups can ensure that they are well positioned for enduring economic downturns and emerge prepared for better economic times ahead, even in the most trying circumstances such as today’s pandemic environment.

More information about this subject is available in a free webinar, “Three Different Perspectives on Navigating Radiology’s Recovery Curve from COVID-19,” which features Howard Kessler, MD, medical director of Aligned Imaging, LLC, and Allan Swenson, vice president of services strategy for Aligned Imaging. You can register for the webinar here.

— Andrew Colbert is a senior managing director and founding member of Ziegler's Healthcare Investment Banking practice.

Disclaimer: This publication is designed to provide accurate information regarding the subject matter covered. It is provided for informational purposes only with the understanding that the material contained herein does not constitute legal, accounting, tax, or other professional advice. Although information which may be contained in this publication has been obtained from sources which we believe to be reliable, we do not guarantee that it is accurate or complete and any such information may be subject to change at any time. The information presented and discussed is based on a newly enacted Federal program, and as such, many questions and provisions are subject to change. This publication may contain forward-looking statements, which may or may not come to fruition depending on certain circumstances.