Billing and Coding: Ushering In 2022

Billing and Coding: Ushering In 2022

Melody W. Mulaik, MSHS, CRA, RCC, RCC-IR, CPC, COC, FAHRA

Radiology Today

Vol. 23 No. 1 P. 8

While there are not many coding changes for 2022, there are some key items that do impact radiology practices. It is always important to review all the changes to determine how they may impact your organization. Let’s start with some key regulatory and reimbursement updates and then address the coding changes.

New for 2022

The Centers for Medicare & Medicaid Services (CMS) finalized a flexible effective date for the appropriate use criteria (AUC) program payment penalty phase to begin the later of January 1, 2023, or the January 1 that follows the declared end of the public health emergency for COVID-19. Some other key items in the Medicare Physician Fee Schedule (MPFS) Final Rule regarding AUC include guidance related to changed orders, second opinion interpretations, clinical trials, exemption for critical access hospitals, services furnished under the Maryland Total Cost of Care Model, inpatients converted to outpatients, claims rejections, Medicare as secondary payer, services ordered prior to the AUC effective date, and AUC modifiers.

As part of the calendar year (CY) 2022 MPFS final rule, CMS defines a split (or shared) visit as an evaluation and management (E/M) visit performed (split or shared) by both a physician and nonphysician practitioner (NPP) who are in the same group, in accordance with applicable laws and regulations for new and established patient visits, eg, the visit is provided in a facility setting in which payment for services furnished incident to the visit is prohibited. In the nonfacility setting, when the physician and NPP each perform components of the visit, it can be billed under the physician if the incident-to criteria are met. The services must be provided in accordance with applicable laws and regulations, specifically either the physician or NPP must be eligible to bill the payer directly for the visit in the facility setting, rather than bill as a split (or shared) visit. Additionally, CMS will allow for split (or shared) visits to be billed for both new and established E/M patient visits.

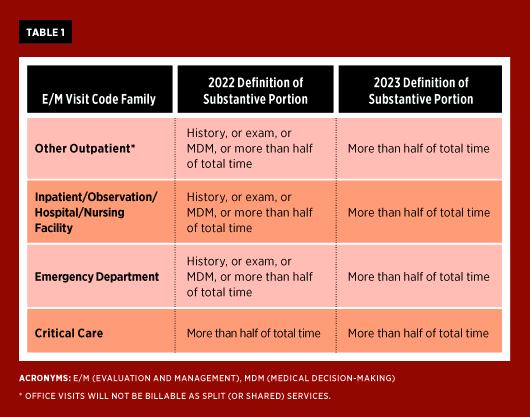

CMS also clarified that only the physician or NPP who performs the substantive portion of the split (or shared) visit may bill for the visit. CMS defines the “substantive portion” to mean more than one-half of the total time spent by the physician or NPP performing the visit. For Medicare, CY 2022 will be a transitional year; except for critical care visits, the substantive portion will be defined by one of three key components—history, exam, or medical decision-making—or more than one-half of the total time spent by the physician and NPP performing the split (or shared) visit and require a yet-to-be defined modifier when billed on the claim. To outline the differences between CY 2022 and 2023, CMS provides the table below to demonstrate the substantive portion as defined for each year (see Table 1).

According to CMS, the time between the physician and NPP are totaled; the practitioner with more than one-half of the time will bill the visit based on total time documented. The substantive portion could comprise time with or without direct patient contact. One of the practitioners performing the visit must have face-to-face (in-person) contact with the patient, but it does not have to be the practitioner who performs the substantive portion and bills for the visit. CMS determined that prolonged services could be billed in addition to the visit, when the time-based method is used, with the total time between the two entities used for billing. This would only apply for other outpatient and inpatient/observation/hospital/nursing facilities. Use of prolonged services would not apply to emergency department and critical care visits.

If the physician and NPP are not in the same group, they would each be expected to bill independently based on the full E/M criteria for the work provided. If neither of them meets the criteria to bill a visit, modifier 52 for reduced services cannot be applied to the E/M visit codes. In this scenario, no visit would be billable by either entity.

The physician reimbursement cuts that were scheduled to take effect on January 1, 2022, were changed on December 10, 2021, when President Biden signed into law the Protecting Medicare and American Farmers from Sequester Cuts Act. This Congressional action changed the payment for services paid under MPFS. The conversion factor will be increased by 3% from what was finalized in the 2022 MPFS Final Rule. Originally a 3.75% decrease from the 2021 value was used when calculating the new value for 2022. Additionally, the 2% sequestration adjustment to every service paid by CMS will still be suspended through March 31, 2022. Beginning on April 1 through June 30, 2022, a 1% adjustment will be applied to all payments, and, beginning July 1, 2022, the 2% usual sequestration will be reinstated. The Pay-As-You-Go, or PAYGO, 4% adjustment, which was to be applied beginning January 1, 2022, is suspended until January 1, 2023, and will be applied, if needed. This will be an additional decrease to any other sequestration per service as paid by CMS.

Coding Changes

The following is a high-level summary of some of the procedure coding changes. The CPT manual should be reviewed in detail to ensure identification of all relevant additions, deletions, and revisions. The procedure codes for Radiologic exam, complex motion (76101–76102) and Epidurography, Radiological Supervision and Interpretation (72275) have been deleted for 2022.

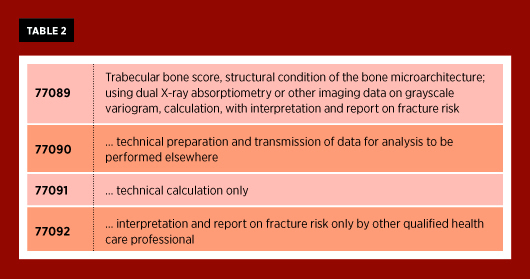

Four new codes have been added for trabecular bone score studies (see Table 2).

Several new Category III codes have been added to represent new technologies. All of the definitions of the new codes should be reviewed in detail to ensure appropriate code assignment. As with all Category III codes, the presence of a code does not guarantee reimbursement, so individual payer policies must be reviewed.

• Category III code 0691T was added to represent automated analysis of an existing CT study for vertebral fracture(s), including assessment of bone density when performed. This code should only be used when data from an existing CT study are analyzed and not concurrently during a newly acquired CT exam.

• Codes 0554T–0557T were introduced for bone strength and fracture risk using finite element analysis of functional data and bone mineral density, utilizing data from a CT scan.

• Insertion of a percutaneous gastrostomy tube with magnetic gastropexy under ultrasound guidance is now reported with the new code 0647T.

• Laser ablation of a benign thyroid nodule(s) now has a Category III code, 0673T, to report this procedure.

• Codes 0689T–0690T were created for nonelastographic quantitative ultrasound for tissue characterization.

• Code 0694T was created for 3D volumetric imaging of a breast specimen.

• Effective July 1, 2021, codes 0697T–0698T and 0648T–0649T are now available for quantitative MR for analysis of tissue composition.

• Four new codes (0710T–0713T) were added to represent noninvasive arterial plaque analysis using software processing of data from noncoronary CT angiography (CTA). This may be done on the same date or a different date of service from the original CTA image acquisition. These codes apply to plaque analysis of noncoronary CTA data only, eg, extremities, abdomen, pelvis.

2022 looks to be another interesting year. Stay tuned for more updates, changes, twists, and turns.

— Melody W. Mulaik, MSHS, CRA, RCC, RCC-IR, CPC, COC, FAHRA, is the president of Coding Strategies, Inc, and Revenue Cycle, Inc.